Education Planning

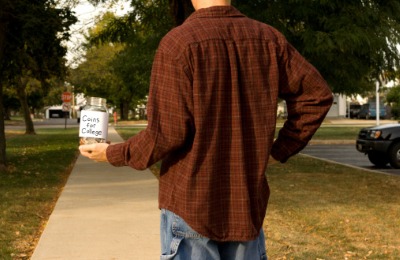

Without prudent educational planning, individuals and families are often left scrambling to manage and fund the higher-educational aspirations of their own or that of their families. The cost of higher education only increases which may have you worried, can I do this?

Without prudent educational planning, individuals and families are often left scrambling to manage and fund the higher-educational aspirations of their own or that of their families. The cost of higher education only increases which may have you worried, can I do this?

What Spectrum Can Do For You

We have helped countless young men and women and their families make socially and financially-informed decisions about their education plans.

We’ll help you take the guess-work out of planning for future educational needs – whether it’s for yourself or for a family member (child, ward, grandchild). We do this by creating a forward-looking financial plan of estimated education costs and expenditure. Our team will help you put tax-advantaged strategies in place that are in accordance with a myriad of Federal and State laws.

Investors should consider the investment objectives, risks, charges and expenses associated with municipal fund securities before investing. This information is found in the issuer's official statement and should be read carefully before investing.

Investors should also consider whether the investor's or beneficiary's home state offers any state tax or other benefits available only from that state's 529 Plan. Any state-based benefit should be one of many appropriately weighted factors in making an investment decision. The investor should consult their financial or tax advisor before investing in any state's 529 Plan.